- #Noi calculation spreadsheet how to

- #Noi calculation spreadsheet full

- #Noi calculation spreadsheet free

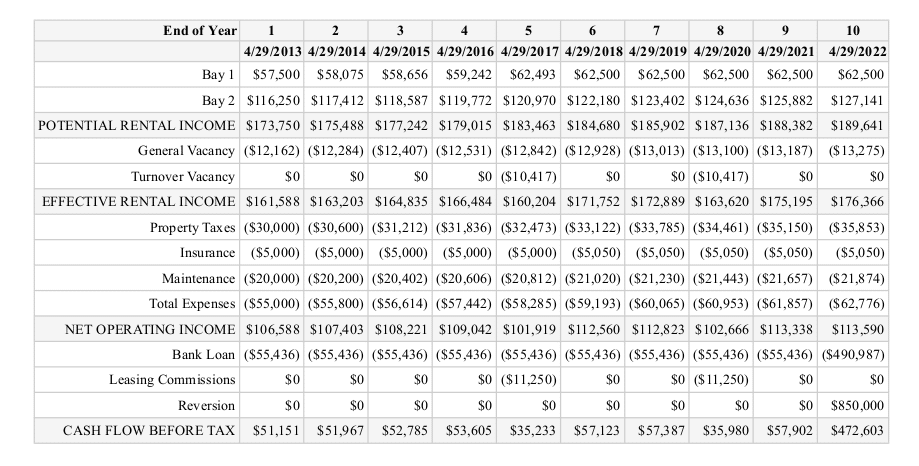

Simple Calculation: If the management fees are 3% of EGI and EGI is $1 million, then these fees are $30,000. Property Management Fees exist because owners rarely manage their properties directly instead, they hire 3rd party management companies to deal with tenants, collect rent, resolve problems, and set up repairs and maintenance. Some are projected based on a % of Effective Gross Income, some are based on $ per square foot or $ per square meter figures, and some are percentages of the property’s value. Operating ExpensesĬommon operating expenses include property management fees, utilities, maintenance, insurance, sales & marketing, general & administrative, property taxes, and reserves. Simple Calculation: If this same 10,000-rentable-square-foot building has 1,000 square feet that is always empty, the General Vacancy line item would be 10,000 * 10% * $50 = $50,000.Īs in the screenshot above, t would appear with a negative sign on the pro-forma since it represents a deduction from “potential revenue.”Įffective Gross Income sums up all these adjustments and is similar to Net Revenue or Net Sales for normal companies, but on a Cash basis rather than an accrual basis. General Vacancy is for space that’s “permanently vacant,” AKA there is no tenant and no plans for one anytime soon. Simple Calculation: If a tenant renting 2,000 square feet is responsible only for its share of property taxes, and property taxes for the entire 10,000-rentable-square-foot building are $50,000 per year, then this tenant must pay (2,000 / 10,000) * $50,000 = $10,000.

#Noi calculation spreadsheet free

Simple Calculation: If a tenant is renting 2,000 square feet for $50 per square foot per year, this tenant leaves, and it takes 6 months to find a new tenant, then the Absorption & Turnover Vacancy is 2,000 * $50 * (6 / 12) = $50,000.Ĭoncessions & Free Rent is used for when a new tenant moves in, or an existing tenant renews, and you grant “free months of rent” as an incentive.Įxpense Reimbursements are an addition to revenue and represent tenants’ proportional share of property taxes, insurance, and maintenance/utilities. It’s not an expense, but rather “foregone rental income.” Simple Calculation: If the property has 10,000 rentable square feet and the market rate is $50 per square foot per year, the Base Rental Income is $500,000.Ĭommon deductions and adjustments are ones for the Absorption & Turnover Vacancy, Concessions & Free Rent, Expense Reimbursements, and General Vacancy.Ībsorption & Turnover Vacancy is for the months of downtime when a tenant leaves, and it takes time to find a new tenant.

#Noi calculation spreadsheet full

Here’s a simple example of the real estate pro-forma and each section on it:īase Rental Income at the top represents this “potential revenue” with 100% occupancy and full market rents paid by tenants. Then, you list the “capital costs” (similar to CapEx and the Change in Working Capital for normal companies) that correspond to long-term items that will last for more than 1 year.įinally, you show the Debt Service (Interest and Principal Repayments) and the Cash Flow to Equity at the bottom. Next, you list the operating expenses required to run the property’s day-to-day operations.

You always start with Potential Revenue, if the property were 100% occupied and all tenants paid market rates, and then make deductions. The Shape of the Real Estate Pro-Forma and Simple Calculations Properties do have financial statements, but for modeling and valuation purposes, we can simplify and just project the Pro-Forma – as we often do when valuing companies with a DCF and projecting only their cash flows. The Real Estate Pro-Forma is a simplified and combined Income Statement and Cash Flow Statement for properties, with a few modifications – such as no Income Taxes and no Depreciation in most cases. Just as you need to understand the financial statements to grasp financial modeling and valuation for normal companies, you must understand the Pro-Forma if you want to understand real estate.

#Noi calculation spreadsheet how to

0 kommentar(er)

0 kommentar(er)